INDUS Share

The 2020 Stock Market Year: Significant Influence From the Coronavirus Pandemic

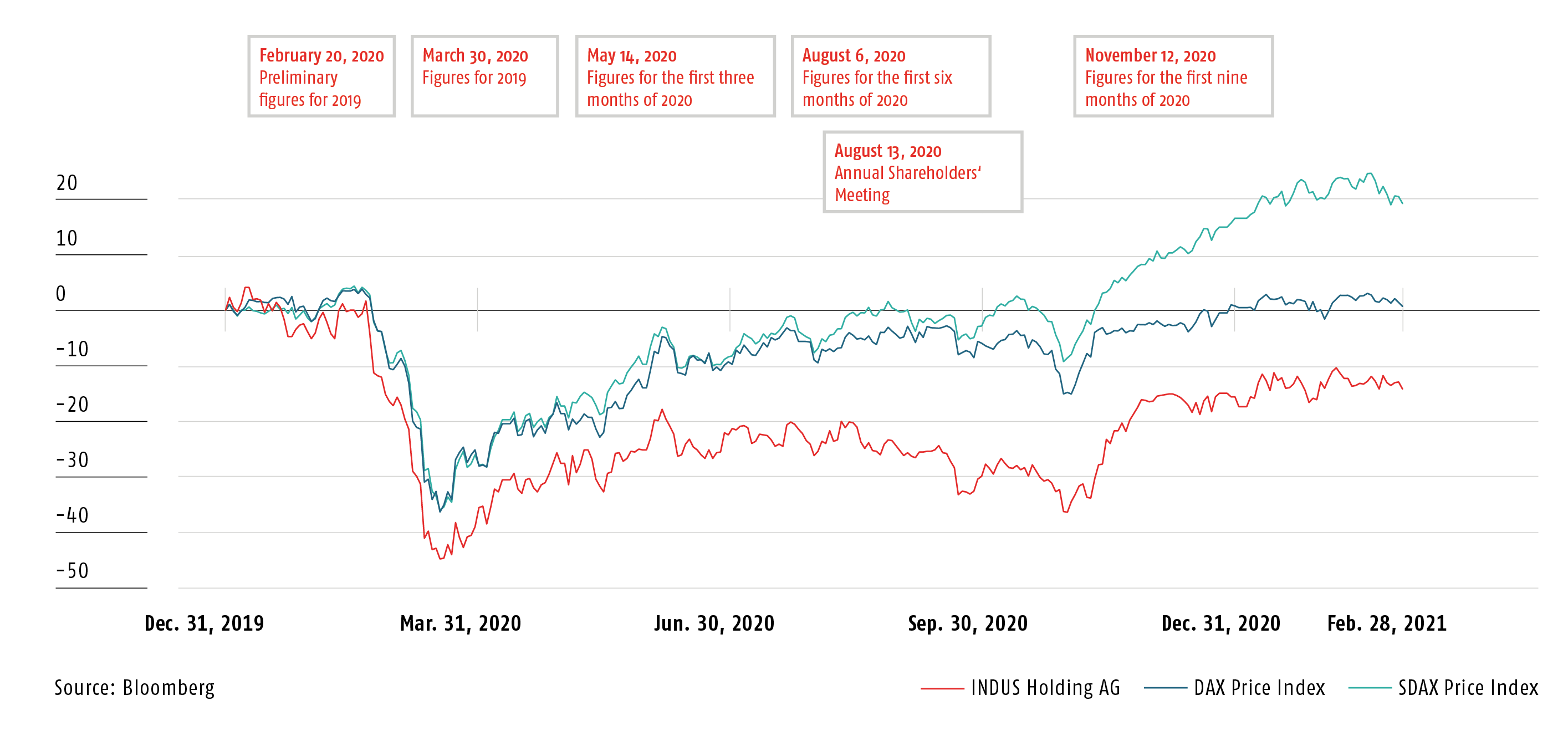

The 2020 STOCK MARKET year was dominated by the coronavirus and thus shaped by high volatilities. The pandemic was already affecting the global economy in February. The economic downturn was twice as deep as in the financial crisis and occurred significantly more quickly. This led to unprecedented falls in prices on capital markets.

However, the losses were almost completely wiped out again by the end of the third quarter, although the “second wave” in October then caused stock markets to correct once more. The market then continued in a negative trend until the outcome of the US election, enormous state liquidity measures and guarantees, and the news that vaccines to combat the virus would be available in the near future caused it to trend positively again.

At the end of the year, at 13,201 points (as of December 21, 2020) the DAX, which is a broad-market index, was only around 4% lower than its high of February 19, 2020, of 13,789 points. This is all the more remarkable, as it reached a low of 8,841.71 points in mid-March. In other words, investors saw a range of variation of almost 40% in the year.

The INDUS Share: Unfavorable Share Price Performance in the Volatile Market Environment

At the start of the reporting period, the INDUS share remained stable and even occasionally traded above the EUR 40 mark up to February 21, 2020 (the annual high was EUR 40.45 on January 8, 2020). It then, similarly to the market as a whole, fell to an annual low of EUR 21.40 on March 18, 2020, due, in particular, to pandemic concerns on capital markets.

However, the subsequent recovery following the significant price losses, which also affected members of the SDAX, was less strong: By the start of June, the price had recovered to EUR 31.90, only to hit a low of EUR 24.70 on October 28, 2020. From there, the share recovered again – partly because the capital market was further informed of a recovery from the coronavirus shock in the form of positive Q3 figures on November 12, 2020 – and has leveled off at between EUR 30 and EUR 32 since mid-November 2020.

At the end of the year, it closed at EUR 32.10, which was equivalent to a drop of 19.25% since the start of the year.

Liquidity of the Share: Increase in the Reporting Year

The liquidity of the INDUS share visibly increased in the reporting year. On average, according to the statistics of the German Stock Exchange, 28,585 shares were traded per day on XETRA and the German regional exchanges during the financial year. This amounted to an average of 21,940 shares a day in 2019. In addition, larger trades were made outside of the exchanges: Just over 76% of trading volume was on XETRA and regional German stock markets, according to Bloomberg, and was traded just above the level of the previous year.

KEY SHARE DATA (in EUR)

| 2020 | 2019 | 2018 | |

|---|---|---|---|

| Earnings per share Group | -1.10 | 2.43 | 2.90 |

| Cash flow per share Group | 6.35 | 6.02 | 3.05 |

| Dividend per share1 | 0.80 | 0.80 | 1.50 |

| Dividend yield in %1 | 2.5 | 2.1 | 3.8 |

| Sum disbursed in EUR million1 | 19.6 | 19.6 | 36.7 |

| Year-high closing price2 (Jan. 8, 2020) | 40.45 | 47.45 | 66.00 |

| Year-low closing price2 (Mar. 18, 2020) | 21.40 | 31.45 | 37.65 |

| Price at year-end2 | 32.10 | 38.85 | 39.00 |

| Market capitalization3 in EUR million | 784.86 | 949.90 | 953.57 |

| Average daily trading volume in number of shares | 28,585 | 21,940 | 24,711 |

1) Subject to approval at Annual Shareholders’ Meeting on May 26, 2021

2) XETRA closing price

3) As of reporting date, based on complete capital stock of 24,450,509 shares

SHARE PRICE PERFORMANCE OF THE INDUS SHARE IN 2020 EXCL. DIVIDEND (in %)

Stable Shareholder Structure With Many Institutional Investors

INDUS Holding AG’s largest shareholder remains Versicherungskammer Bayern in Munich. In line with its long-term capital investment strategy, it holds 19.4% of the capital stock (according to the Board of Management’s knowledge). The other anchor is formed by a group of private investors who are represented jointly. The spokesman for the group of proxy shareholders is Hans Joachim Selzer of Driedorf, Germany. This group holds 5.8% of INDUS shares, according to its own statements. Epina GmbH & Co. KG, Gütersloh, became one of INDUS Holding AG’s larger shareholders in November 2017. The rest of the company’s share capital (71.8%) is held by a broad range of investors. INDUS Holding AG currently does not hold any treasury shares.

Shareholder Base INDUS Holding AG as of 31.12.2020

a

Versicherungskammer Bayern – 19.4

b

H. J. Selzer et.al – 5.8

c

Epina GmbH & Co. KG – 3.0

d

Free float* – 71.8

* The German Stock Exchange defines free float as all shares not held by major shareholders (share of share capital of at least 5%). According to this definition, free float amounts to 74.8%.

Source: Company information

The INDUS share has price potential

a

Buy — 6

b

Hold — 1

- Commerzbank (EUR 30.00) – hold

- FMR (EUR 38.50) – buy

- Hauck & Aufhäuser (EUR 41.00) – buy

- HSBC (EUR 50.00) – buy

- Independent Research (EUR 38.00) – buy

- LBBW (EUR 38.00) – buy

- M.M.Warburg (EUR 39.00) – buy

Average price target: EUR 39.21

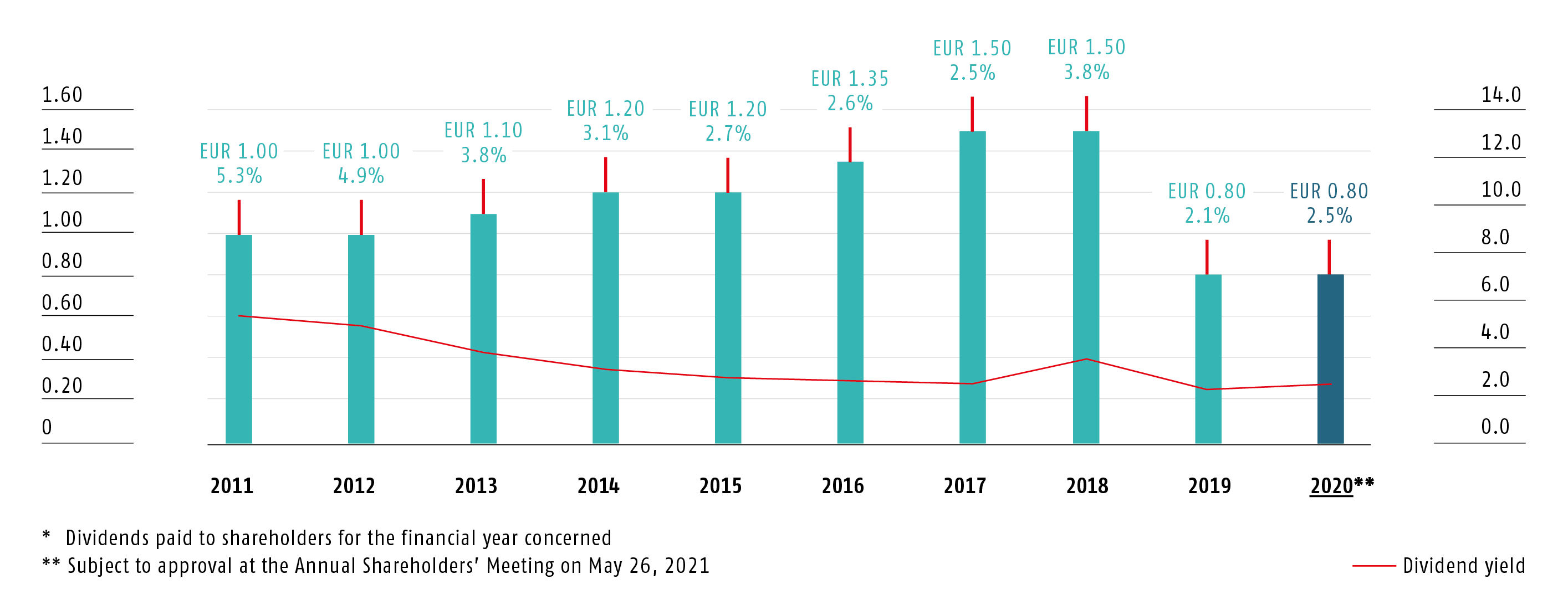

Distribution: Proposed Dividend of EUR 0.80 per Share

INDUS practices a stable dividend policy. Shareholders participate in company profits through regular dividend distributions. The dividend distribution generally depends on the net profit for the year. The dividend policy provides that at least 50% of profits are to be reinvested in the company and up to 50% distributed.

As of December 31, 2020, the holding company had EUR 35.8 million in balance sheet profit. The Board of Management and the Supervisory Board will therefore propose a dividend payment of EUR 0.80 per share (previous year: EUR 0.80) to the Annual Shareholders’ Meeting. This brings the total sum disbursed to EUR 19.6 million with a dividend payout ratio of 54.6%.

Key data INDUS Share

| WKN / ISN | 620010 / DE0006200108 |

| Ticker | INH.DE |

| Share class | Non-par bearer shares |

| Stock exchanges | XETRA, Düsseldorf, Frankfurt (regulated market); Berlin, Hamburg, Hannover, München, Stuttgart |

| Market segment | Prime Standard / SDAX |

| Designated Sponsors | Commerzbank, ICF, Hauck & Aufhäuser |

| Subscribed Capital | 63,571,323.62 EUR |

| Authorized Capital 2019 | 31,785,660.51 EUR |

| No. of shares | 24,450,509 |

Dividend per share* with dividend yield 2011 to 2020 (in EUR/in %)

Investor Relations Work: Strong Interest in Digital Formats During the Coronavirus Pandemic

A key topic in the dialogue with the capital market in 2020 was the information on the company’s current performance. Over the reporting period, the Board of Management sought a continuous exchange of views with existing and potential investors. It used almost exclusively digital formats for this due to coronavirus constraints.

Despite the digital format, INDUS saw no drop in interest from the capital market but a pure digitalization of events. In the reporting year, twelve roadshows or conferences were held with international and national investors. At presentations by the Board of Management, interest increased considerably in some cases as a result of the digital format. In addition, greater use was made of the format of sales force briefings in order to ensure the same level of information between analysts and the sales force.

INDUS maintains dialogue with private investors through the Annual Shareholders’ Meeting, participating in the DSW Investor Forum and through personal contact. Interested investors can stay abreast of current events through the INDUS newsletter.

By actively cultivating relations with the capital markets, INDUS underscores its commitment to transparent and regular communication. The FINANCIAL CALENDER provides an overview of the most important dates for the current financial year. The financial calendar is regularly updated and is also available on the company’s website.